Our approach

Although investing in newly developed residential properties may, sometimes, offer tax optimization benefits, many investors tend to favour existing older residential properties for several reasons: better location, higher returns on investment, higher upside potential through renovations and upgrading, higher liquidity, and stronger resilience throughout the real estate cycle.Which projects to choose in which economic context?

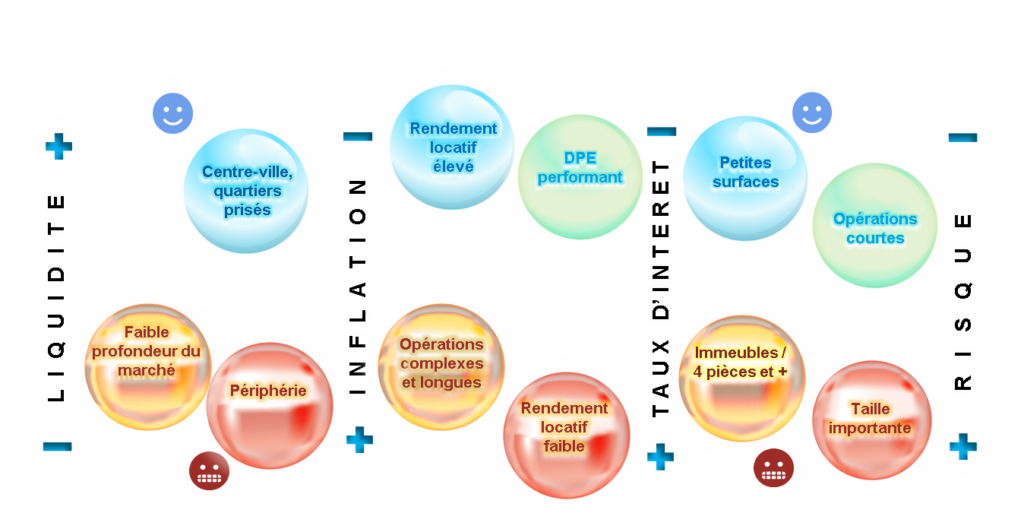

Various categories of real estate behave differently throughout the real estate cycle. During a booming economic context, most real estate investors are seeking higher-risk projects that offer higher upside potential.

Eventually, when the market is slowing down, real estate investors would rather invest in real estate assets with a more balanced risk-return profile, defensive features, and stronger cash-flow resilience, as such investments would prove to be more suitable for most investors.

Investors need to adapt their perspective to the vastly evolving demand and to the context that influences this demand. A wise decision will make the difference in the long-term.